Chinese Log Market Collapsing?

The past week has seen news emerge that the Chinese export log price is about to tumble.

From a peak of $158/jas AWG for A grade back in March 2019 we are now set to arrive at $108/jas AWG for July 2019. That’s a drop of $50/jas in the past 3 months.

We’ve been here before with a similar correction in 2015 of just over $40/jas in one hit but this time the outlook is tempered by the fact that no one knows where the bottom is likely to end up and whether there’s going to be a recovery on the other side once we get there.

The trade war with the USA is starting to weigh on the Chinese economy and with growth slowing you have to wonder when the point will arrive where additional monetary stimulus is no longer an option to retain momentum.

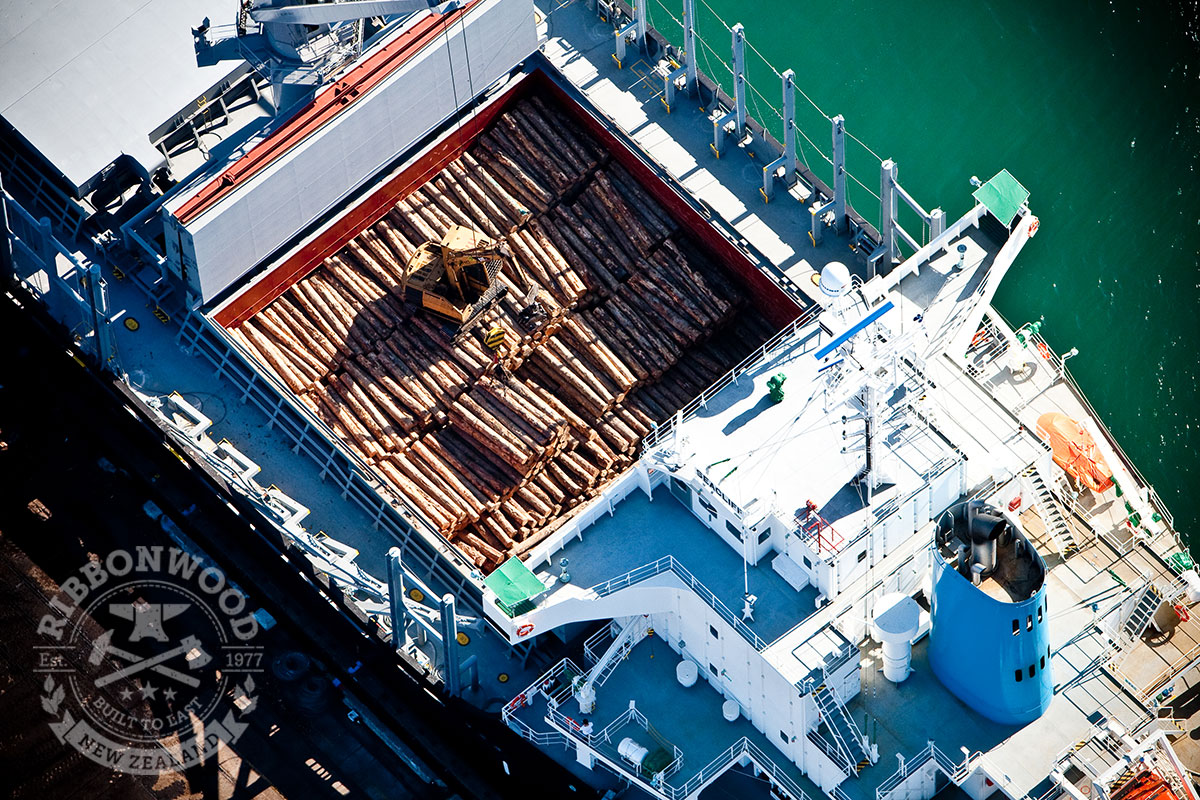

This time around a number of factors have come together to influence the situation including what has been reported to be a record number of log vessels from NZ shipping in May. Normally we are starting to slow down with the onset of winter but this year it feels like the hot dry summer refuses to let go.

We are also seeing contractors in the private and third-party sector gear up with new equipment and additional people to boost productivity. Previously in the past there just hasn’t been the confidence to do this but the last three years of consistent demand and pricing industry perceptions have changed.

A lot of new contractors won’t have experienced a severe downturn.

Currently inventory in China sits at around 4.3 million tonnes with no shortage of logs out of Russia. Construction activity is down with high temperatures and a shift of activity inland. The currency devaluation they have experienced recently hasn’t helped the situation.

Some insiders are predicting the A grade price will go below $100AWG by September and if that’s the case it will see forest owners reduce harvest levels or stop altogether as they weigh up the value loss against the possible loss of harvest and cartage capacity.

Like turning a big ship around it will still take three months for the churning NZ log production factory to finally slow down and allow a proper reset. This will only happen if a proportion of harvesting stops. Whether there will a big enough reduction in Chinese demand and our supply before we get out of summer 2020 remains to be seen.

Many are already starting conversations with “But we’ve had a good run”, yet in an industry that requires 5-10 years to pay off some of the associated equipment throughout the supply chain, three consistent years isn’t really too flash but remains better than the rolling average in most cases.

Whatever the outcome is, it’s not going to be an easy time for the industry and its participants, and the impacts and ramifications may well be felt far and wide over the coming months if not hitting home already.